BKF (Badan Kebijakan Fiskal or Fiscal Policy Office) hosted an FKP seminar on 21 July 2017 at Ministry of Finance, Jakarta. This seminar brought up the general topic of inequality and its relevance to Indonesia, which was later being explained in a more specific manner by Budy Resosudarmo (the Australian National University) and Eko Wicaksono (BKF). Each speaker presented two studies respectively: 1) A Sectoral Growth-Income Inequality Nexus in Indonesia, and 2) The Source of Income Inequality in Indonesia: A Regression-Based Inequality Decomposition.

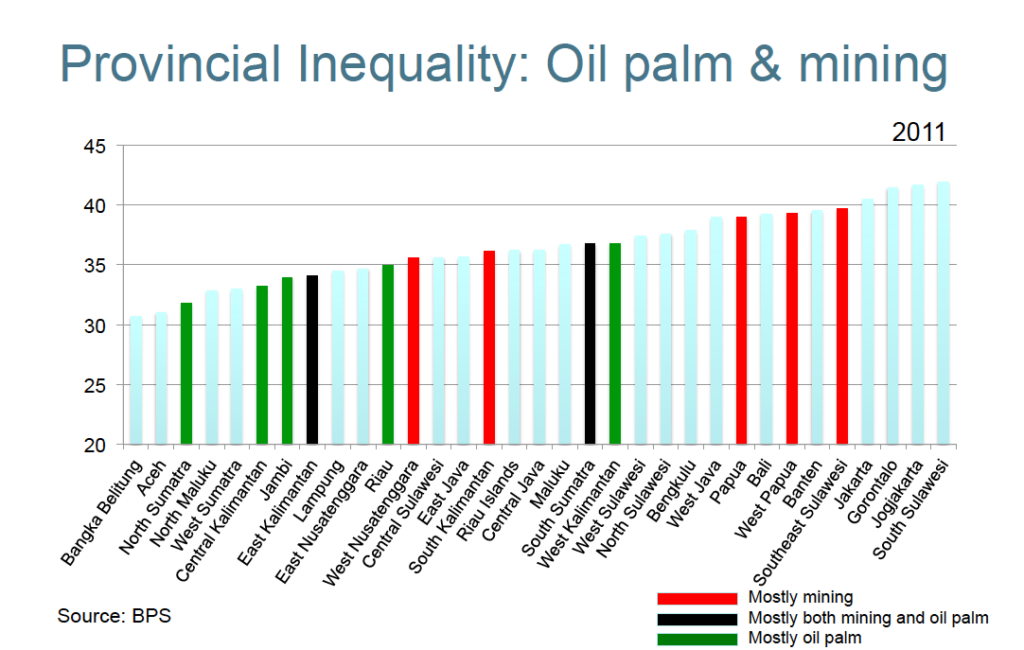

Budy Resosudarmo (starting minute 5:57 of the video) started off his presentation with an introduction to the past studies on inequality, many of which discussed between-country inequality while lacking in the focus on within-country analysis. Given the current situation where the figures of within-country inequality in developing countries continue to grow each year, Budy Resosudarmo and Iván González, as the writers of the paper, felt the urge to delve further into the respective issue, with giving particular attention to inequality disparities across sub-regions in Indonesia. Provincial inequality data in 2011 shows that several provinces with high-income disparity relied on mining industry majorly, meanwhile palm oil producing provinces experienced relatively low rate of income inequality. The phenomenon was a consequence of, partly, the changing of sectoral share in the economy because palm oil had taken over the largest exported commodity role from oil and mining commodities. The study expands its purpose to provide evidence of a causal relationship between sectoral economic growths and income inequality in Indonesia.

Using district-level dataset from 2000-2010 extracted from INDO-DAPOER by the World Bank, the study constructs the variable of ‘equality’–the ratio between the average household expenditure per capita of the bottom 20% and the average household expenditure per capita at each district– to substitute Gini coefficient (which lacks sensitivity and by nature tends to be biased downwards). The basic model of this study includes additional control covariates such as government expenditure and the quality of each local government. As for the agricultural sector, a separate model using instrumental variable of average annual precipitation and temperature is also established. The basic results suggest that only the increase in the share of agricultural sector that evidently correlates with a reduction of income inequality. However the results cannot justify the encouragement of agricultural sector alone. The growth in the manufacturing and service sectors is also necessary, yet it should be accompanied by targeted interventions to achieve inclusive growth.

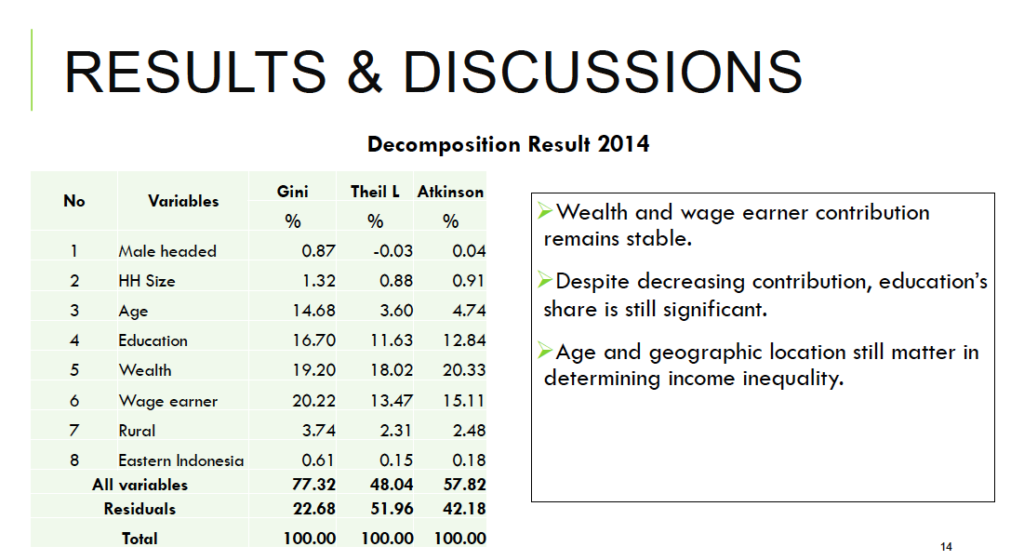

A study presented by Eko Wicaksono (starting minute 42:23 of the video) uses micro approach hence giving a complementary perspective about income inequality in Indonesia. Using household-level data from IFLS (Indonesian Family Life Survey) of the year 2000, 2007, and 2014, this study tries to elaborate the root of inequality in Indonesia. Based on the logical framework built upon past literatures on inequality in developing countries, the study puts more emphasis on the basic characteristics of a household and educational attainment of household head. Decomposition procedure using Shapley value method was conducted to give a clearer view of what factors underlie inequality at household-level in Indonesia.

Regression and decomposition results indicate that educational attainment of household head was the largest contributor of income inequality in 2000 (20.99%), followed by wealth that acted as an endowment point of a household (19.07%). Despite the significance of educational level contribution to income inequality, the share was decreasing over the years and has been replaced by wealth and the number of wage earner in a household. Eko stated that income inequality in Indonesia was still revolving around the issue of unequal access to opportunity, especially access to financial markets, shown by the increasing contribution of wealth in the decomposition result. The options available were many, but one of the most palpable alternatives suggested by the study were working harder on designing a proper progressive income tax while enforcing the existing law.

![[FKP hosted by Universitas Padjadjaran] Kesehatan ibu pasca melahirkan di Indonesia](https://www.fkpindonesia.org/wp-content/uploads/2024/02/fkp-2024-02-21-thumbnail-500x383.jpg)

![[FKP hosted by ANU Indonesia Project] The pursuit of food self-sufficiency in Indonesia: food-trade policy preferences during the administrations of Yudhoyono (2004-2014) and Widodo (2014-present)](https://www.fkpindonesia.org/wp-content/uploads/2024/01/fkp-2024-01-16-500x383.jpg)

![[FKP hosted by ANU Indonesia Project & SMERU] Prepayment, price, and welfare: a study on electricity demand in Indonesia](https://www.fkpindonesia.org/wp-content/uploads/2023/02/fkp-2024-01-19-thumbnail-summary-500x383.png)