Reported by Adinda Rizky Herdianti

The Indonesian Institute of Sciences (LIPI) hosted the FKP seminar series during the month of April 2017. Alexander Rothenberg (RAND Corporation) presented his team study entitled “When Regional Policies Fail: An Evaluation of Indonesia’s Integrated Economic Development Zones” where he evaluates the short and long-run impacts of Indonesia’s Integrated Economic Zones (Kawasan Pengembangan Ekonomi Terpadu, KAPET).

In theory, place-based policies such as economic zone seem to be promising for country with large spatial inequalities to stimulate growth in lagging regions for several reasons. The widely used mechanism is offering tax incentive or subsidy for firms located in certain areas. Incentive and subsidy may attract the least productive firms since they are mostly producing at inefficient cost structure. Substantial amount of money invested in place-based policies also may attract enough manufacturing activity to constitute a “big push” which is called threshold effect and multiple equilibria. The most prominent economic zone, such as Silicon Valley, also gives a precedent of productivity spillovers between firms that are located in close proximity.

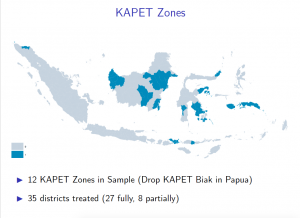

The Indonesian government established KAPET in 1996 to address disparities amongst regions, particularly between Java and non-Java regions. KAPET targeted poorer district in outer islands, which were classified into 13 zones. KAPET offered fiscal and accounting incentives such as tax cuts (capital, 30%; building and land taxes, 50%), wage subsidy (50% of employee costs), and partial tax holiday for 10 years. In addition, several programs targeting MSMEs such as loan assistance and one-stop-shop licensing promotion were also included in KAPET. With such benefits offered to firms located in KAPET zones, straightforward comparison of 35 treated districts and non-treated districts may lead to underestimating impacts of KAPET on the firms. Hence, this study uses a propensity-score re-weighting strategy to compare KAPET districts to other non-treated districts in outer islands.

Rothenberg and his team extracted data related to demographic outcomes and migration, geographic characteristics (slope, ruggedness, distance to ports, rivers, and coasts), firm-level information, and night-time light intensity. The regression results show that medium and large firms enjoyed strong reduction in taxes on sales, licenses, buildings, and land. There was also a slight increase in labor for incumbent firms, which were mainly medium and large firms, indicating that a possibility that wage subsidy did reduce firms’ labor burden. Not only medium and large firms who benefited from KAPET, there are also some possible productivity gains for micro and small firms. However, KAPET has no significant effects on population movements, entry of firms, and overall GDRP. Generally, the results suggest that KAPET failed to achieve its goal of reducing disparities and boost local economy.

The next step suggested by Rothenberg was to study the possibility of heterogeneous implementation of KAPET and similar policies, since Indonesia started to adopt decentralization in 2000s. He also mentioned the need to identify the agglomeration function of regions across Indonesia to improve place-based policies planning in the future.

![[FKP hosted by Universitas Padjadjaran] Kesehatan ibu pasca melahirkan di Indonesia](https://www.fkpindonesia.org/wp-content/uploads/2024/02/fkp-2024-02-21-thumbnail-500x383.jpg)

![[FKP hosted by ANU Indonesia Project] The pursuit of food self-sufficiency in Indonesia: food-trade policy preferences during the administrations of Yudhoyono (2004-2014) and Widodo (2014-present)](https://www.fkpindonesia.org/wp-content/uploads/2024/01/fkp-2024-01-16-500x383.jpg)

![[FKP hosted by ANU Indonesia Project & SMERU] Prepayment, price, and welfare: a study on electricity demand in Indonesia](https://www.fkpindonesia.org/wp-content/uploads/2023/02/fkp-2024-01-19-thumbnail-summary-500x383.png)