Reported by Adinda Rizky Herdianti

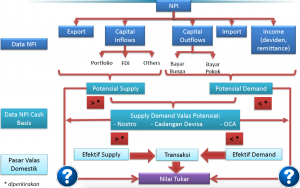

On 28 February 2017, the Department for Central Bank Research (Departemen Riset Kebanksentralan or DRK) of Bank Indonesia hosted the presentation of a a study on the effects of demand and supply of foreign currency on the Rupiah exchange rate. The study was presented by Bayront Rumondor from Department of Economic and Monetary Policy, Bank Indonesia. The study intends to analyze a country’s economic performance using cash-based balance of payments (BOP). The study itself describes all components of cash-based BOP that drives the supply and demand of potential foreign currency and the criteria of supply and demand that affects Rupiah exchange rate, taking to note that not all potential supply and demand will become effective supply and demand of foreign currency. The discrepancy that arises from the difference in effective and potential foreign currency supply and demand (supply-demand gap), however, is able to depict the expectancy towards Rupiah exchange rate. All of these information will enrich policy options for authorities in responding the latest economic trends related to Rupiah exchange rate.

The study highlighted two models found in the literature. The first one is the supply-demand structure of domestic foreign exchange and its implications on exchange rate. The other model is depicting the risk as the main factor that affected exchange rate fluctuations. Departing from these studies, the researchers use a model specification that is adapted from Husman (2005) which consists of the following variables: Rupiah exchange rate to USD, Credit Default Swaps (as a proxy of risk variable of Indonesia), 1-month USD interest rate Libor as offshore interest rate, 1-month Rp interest rate tenor as domestic interest rate, oil price (West Texas Intermediate oil price), price differentials (difference in domestic and US CPI, 2012, constant year), Terms of trade (using export and import goods’ price), and potential and effective supply and demand for foreign exchange.

From the model, the researchers assess the domestic foreign exchange market and conclude that the Indonesian market performed well enough during January 2012-May 2016, with non-residents taking a much bigger share of net transaction volume compared to resident players. The non-resident players’ record net sales in most of the period, while the resident players record net buy in the same period. In general, the overall foreign currency market is still facing excess demand.

The study leads to several results. First, in long run equilibrium, the exchange rate values areaffected by fundamental factors such as price differentials, interest rate differentials, oil price, and terms of trade. In short run equilibrium, however, the exchange rate values are more likely affected by the difference in interest rates, term of trade, Credit Default Swaps, oil price, expectation factors, and foreign supply. Researchers found that effective demand-supply of foreign exchange is significantly affecting the nominal Rupiah exchange rate value, which is in linear with the mechanism of price-creation in ordinary supply and demand rules. On the other hand, potential demand-supply of foreign exchange does not significantly contribute to Rupiah exchange rate determination. This is due to the limited characteristics that only influence liquidity in the domestic market. It will be significant if the available foreign exchange has been converted. In addition to that, supply-demand potential foreign exchange variable that came from local residents are not significantly affecting the Rupiah exchange rate.

The supply-demand gap did significantly affect the nominal Rupiah foreign exchange, however. Therefore the difference in potential and effective supply-demand foreign exchange can be used as an alternative to capture expectations towards Rupiah. Shortly, if there is a higher chance of high expectancy of Rupiah depreciation, then there will be a bigger gap and forcing foreign exchange holder to hold their money to earn higher rate (and vice versa).

In response to these findings, the researchers suggest that policymakers should be cautious in using supply-demand foreign exchange data in policy-making process. Policymakers may use the potential or effective supply and demand of foreign exchange with each distinct characteristic to analyze the fluctuations of exchange rate. In addition, it is important for policymakers to keep the expectancy of market players towards Rupiah exchange rate to support stability by paying attention on the supply-demand gap.

![[FKP hosted by ANU Indonesia Project] COVID-19, food insecurity, and cash transfer in Cambodia](https://www.fkpindonesia.org/wp-content/uploads/2024/02/fkp-2024-03-21-thumbnail-500x383.jpg)

![[FKP hosted by ANU Indonesia Project] Is it a curse or blessing to have a resource-rich neighbour?](https://www.fkpindonesia.org/wp-content/uploads/2024/02/fkp-2024-03-13-thumbnail-500x383.jpg)

![[FKP hosted by Universitas Padjadjaran] Kesehatan ibu pasca melahirkan di Indonesia](https://www.fkpindonesia.org/wp-content/uploads/2024/02/fkp-2024-02-21-thumbnail-500x383.jpg)

![[FKP hosted by ANU Indonesia Project] The pursuit of food self-sufficiency in Indonesia: food-trade policy preferences during the administrations of Yudhoyono (2004-2014) and Widodo (2014-present)](https://www.fkpindonesia.org/wp-content/uploads/2024/01/fkp-2024-01-16-500x383.jpg)